What Does Best Broker For Forex Trading Do?

What Does Best Broker For Forex Trading Do?

Blog Article

Best Broker For Forex Trading - Questions

Table of ContentsThe Ultimate Guide To Best Broker For Forex TradingTop Guidelines Of Best Broker For Forex TradingSome Of Best Broker For Forex TradingBest Broker For Forex Trading for Beginners10 Simple Techniques For Best Broker For Forex Trading

Trading forex entails concurrently acquiring one money and selling an additional. The first currency in the set is called the base money and the second is called the counter or quote money.Portfolio supervisors utilize the forex market to diversify their holdings (Best Broker For Forex Trading). Prior to beginning to trade foreign exchange, it is useful to invest some time finding out about the marketplace and elements such as the threats of using utilize. There are numerous terrific free sources available online to assist you with this, such as the education section of this website

On the other hand, foreign exchange brokers based offshore typically have very little regulatory oversight and are a lot more high-risk to deal with. Several brokers require very low minimum deposits to begin. Actually, there is typically a $0 minimum to open up an account. Due to regulatory demands, some brokers now have a 'Know your Customer' (KYC) questionnaire as part of the application.

It might include some fundamental concerns about trading forex and CFDs. New forex investors ought to be mindful of over night swap charges.

Indicators on Best Broker For Forex Trading You Should Know

Before trading in a real-time account it is a great concept to develop an approach and examination it in a trial account. On top of that, micro accounts and adaptable great deal dimensions permit new traders to experiment actual cash while maintaining threat to a minimum. Beginning a trading journal is a fantastic practice for new investors as it helps to recognize staminas and weak points and track progress.

Trading based upon economic news is an example of a fundamental strategy. An investor may be seeing the United States work report and see it come in worse than the agreement expected by analysts. They may then decide to get EUR/USD based upon an assumption that the buck will deteriorate on the frustrating US information.

Searching for rate outbreaks towards the dominating market pattern is an example of a technical trading method. The London Opening Range Outbreak (LORB) is an example of such a technique. At the time of the London open, investors utilizing this approach search for the rate of GBP/USD to burst out over a recent high or listed below a recent short on the hourly graph with the assumption that price will certainly proceed to fad because instructions.

Here traders search for particular chart patterns that show whether price is likely to reverse or proceed to fad parallel. The Pin Bar is a preferred reversal pattern. Here, price gets to a brand-new high (or low) and afterwards reverses to close near where it opened up, suggesting an absence of sentence among the bulls (or bears).

The 10-Minute Rule for Best Broker For Forex Trading

hold market settings for months and even years. Holding such long-lasting placements in the forex market has the possible benefits of benefiting from significant price fads and likewise being able to earn rate of interest from a positive passion rate differential. The most prominent graph key ins foreign go exchange trading are Bar Charts, Candlestick Charts and Line Charts.

resemble Disallow graphes in that they present the high, low, open, and closing rates for an established amount of time. Candlesticks important site make it simple for investors to comprehend whether the market is favorable or bearish within a provided duration by coloring the area in between the open and close green or red.

Best Broker For Forex Trading Things To Know Before You Get This

just draw a line from one closing price to the next closing price. This graph type makes it simple to watch rate fads but uses little understanding into what happened over each amount of time. Foreign exchange trading can be successful, but the statistics shared by significant brokerage firms show that most of traders shed money.

It ought to also be stressed that timing the market and trying to predict short-term relocations in the market are very hard. Margin is the preliminary funding called for to open and hold a leveraged placement out there. A margin need of 1% equates to offered leverage of 1:100.

Some Of Best Broker For Forex Trading

The spread is the space between the quote and deal (additionally their website understood as 'ask') rates of a currency set. This indicates that the best cost that you can presently acquire EUR/USD is 1.14133 and the ideal cost you can presently offer at is 1.14123.

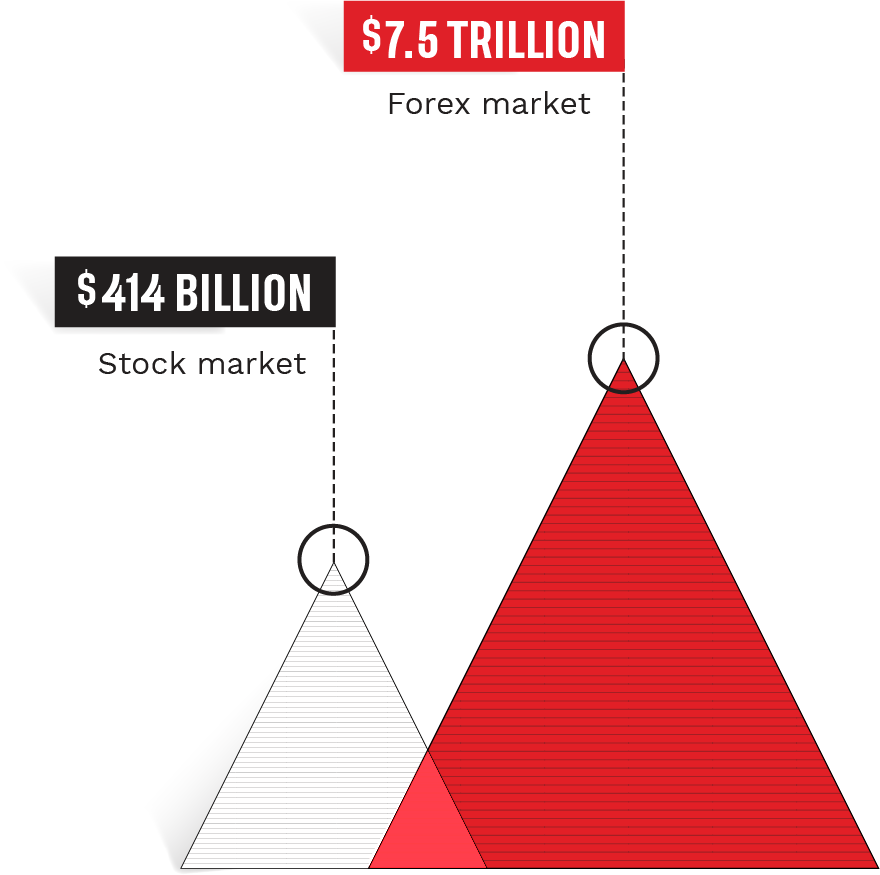

A pipette is one tenth of a pip, typically in the 5th decimal area. Foreign exchange trading has essential benefits and disadvantages contrasted with other markets. Recent growths in the equities market, such as the development of fractional share trading and commission-free trading, have worn down several of the benefits of forex.

Report this page